Imagine you need to send money to a friend in seconds—no fees, no fuss. You open your banking app, tap “Send with Zelle,” and off it goes. It feels free. But behind the scenes, Zelle’s parent banks and networks are turning a tidy profit. In this deep‑dive, you’ll discover how does Zelle make money, why banks are eager to pay, and what the future holds for this juggernaut of P2P payments.

Table of Contents

What Is Zelle and Why It’s “Free” for Users

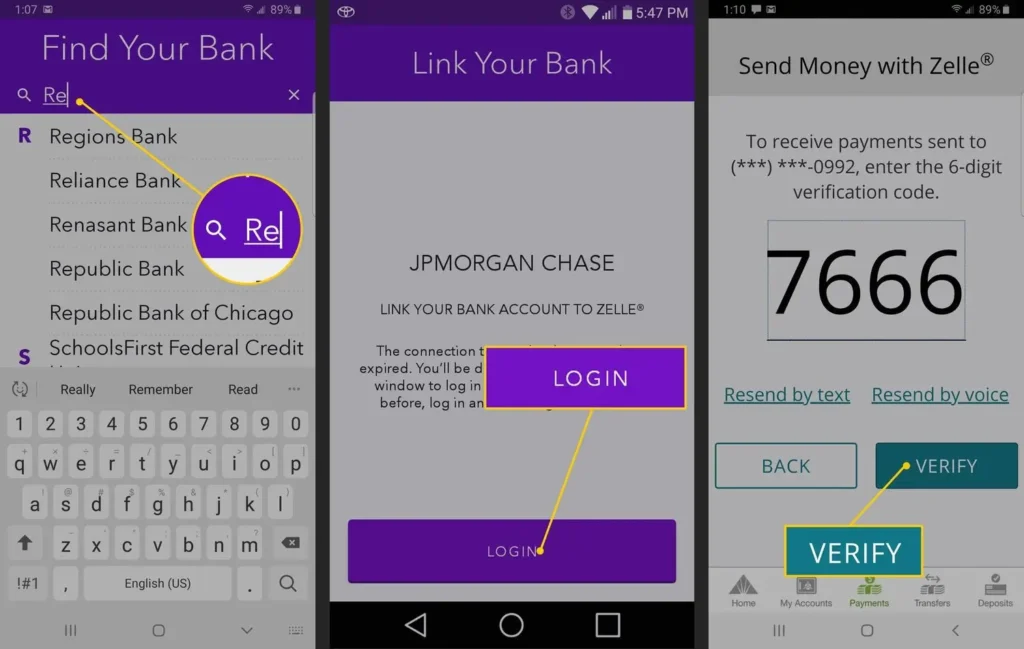

Zelle launched in 2017 through Early Warning Services, a fintech consortium owned by major U.S. banks like Bank of America, Wells Fargo, and JPMorgan Chase. Integrated directly into over 2,000 banking apps (and once available as a standalone app), Zelle lets customers send and receive money instantly—without transaction fees on the user side.

Key Facts & Statistics

- Launched: June 2017

- Users: Over 100 million enrolled as of early 2025

- Transaction Volume (2024): Exceeded $1 trillion in P2P transfers

- Bank Partners: 2,200+ U.S. financial institutions

“Zelle has fundamentally changed consumer expectations around speed. When transfers settle in minutes, fees feel archaic.”

Though you see zero charges, Zelle’s parent network is built on bank-paid models—and that’s where the revenue magic happens.

Zelle’s 7 Revenue Streams Explained

1. Partnership & Integration Fees

Banks pay an annual or per‑installed‑user fee to integrate Zelle into their digital platforms. Costs vary by institution size and volume:

- Large banks: Flat annual licenses (often $1 million+).

- Regional banks & credit unions: Usage‑based models tied to monthly active users (MAUs).

Why it matters: Even modest per‑user fees generate millions when you scale to tens of millions of customers.

2. Transaction Fees Paid by Banks & Credit Unions

Every time you tap “Send,” your bank pays a small fee to the network:

- Fixed + Percentage: Typically $0.03–$0.10 per transaction + 0.02–0.05%.

- Volume Discounts: Banks processing 100 million+ transfers annually negotiate lower rates.

These fees are insignificant to consumers but multiply into high‑margin revenue for Early Warning Services.

3. Merchant Payment Fees

Zelle is branching into merchant payments. When you buy from a small business that accepts Zelle:

- Merchant Fee (~1%): Comparable to debit‑card interchange.

- Settlement to Merchant Bank: Merchant’s bank pays the fee, then splits a cut with Zelle’s network.

This B2B merchant model turns Zelle into a quasi-processor—tapping a new lucrative fee pool.

4. Value‑Added Services & Data Monetization

Financial institutions crave insights. Zelle offers premium modules:

- Fraud Analytics & Alerts: Advanced real‑time monitoring.

- Reporting Dashboards: Transaction trends, customer segmentation.

- Anonymized Data Pools: Aggregated P2P behavior sold to market researchers.

Note: All data is anonymized and GDPR/CCPA‑compliant, but it still holds commercial value.

5. Interest on Float

A small window exists between when funds leave your account and settle in the recipient’s. During that float:

- Interest Income: Held in an omnibus account earning yields (often 0.5–2% APY).

- Aggregate Benefit: Millions in daily outstanding balances translate into meaningful interest.

6. Referral & Cross‑Sell Commissions

Zelle can nudge you toward other bank products:

- Loan & Mortgage Referrals: “Need a loan? Apply now.”

- Savings Accounts & Credit Cards: Embedded offers post‑transfer.

- Commission Splits: Zelle shares revenue with banks when you convert.

This indirect monetization drives lifetime customer value.

7. API Licensing & Fintech Collaborations

Beyond banks, fintech startups integrate Zelle into budgeting apps, payroll platforms, and gig‑economy services via paid APIs:

- Developer Fees: $1,000–$10,000 monthly licensing, depending on call volumes.

- Revenue Shares: Co‑branded products share transaction fees.

This B2B2C approach widens Zelle’s footprint—and its bottom line.

Why Banks Are Willing to Pay Zelle

Banks don’t pay for the fun of it—they see strategic value:

- Customer Retention & Acquisition

- Offering Zelle keeps digital‑savvy users from jumping to Venmo or Cash App.

- Cost Savings vs. Alternatives

- Cheaper than handling paper checks, ACH batches, or manual wires.

- Data & Market Insights

- Access to P2P spending trends helps tailor products.

- Enhanced Engagement

- More frequent app visits strengthen brand loyalty.

Stat: Banks with Zelle integration see a 15% uptick in mobile‑app logins per quarter.

Zelle vs. Venmo & Cash App: Revenue Model Comparison

| Feature | Zelle | Venmo | Cash App |

|---|---|---|---|

| User Fee | $0 per P2P transfer | 1.75% (instant) | 1.5% (instant) |

| Bank Fees | Integration + per‑tx fees | None (parent PayPal covers) | None (parent Block covers) |

| Merchant Fees | ~1% | 1.9% + $0.10 | 2.6% + $0.30 |

| Ownership | Bank consortium (Early Warning) | PayPal | Block, Inc. |

| Data Services | Premium modules to banks & partners | Marketing insights to PayPal | Financial services cross‑sell |

| API Licensing | Yes | Limited | Yes |

| Speed | Minutes (bank‑to‑bank) | Instant (premium) | Instant (premium) |

Risks & Regulatory Pressures Impacting Profitability

Fraud, Chargebacks & Consumer Protection

- Rising Fraud Claims: P2P scams soared 20% in 2024.

- CFPB Scrutiny: Major banks face consumer‑protection lawsuits over liability.

Data Privacy & Monetization Ethics

- Balancing Act: Monetize anonymized data without breaching privacy regulations.

Evolving Payment Landscape

- New Entrants: Real‑time rails like FedNow could undercut pricing power.

- Regulatory Mandates: Open‑banking rules may force lower fees or data-sharing requirements.

Future Revenue Opportunities for Zelle

- Expanded Merchant Ecosystem

- On‑platform shopping, bill pay, and service marketplaces.

- International Remittances

- Partnering with global banks and money‑transfer operators.

- Embedded Finance

- BNPL offerings at checkout, micro‑loans in affiliates.

- Advanced Financial Wellness Tools

- AI‑driven budgeting, savings goals, subscription trackers.

Zelle’s deep bank relationships and P2P volume give it a head start—if it can navigate regulatory and competitive headwinds.

Conclusion: The Hidden Engine Behind Free Transfers

Though you never pay a dime, Zelle makes money in multiple clever ways—bank fees, merchant charges, data services, interest on float, and more. Its consortium model aligns incentives: banks keep customers engaged; Zelle monetizes at the B2B level. As digital payments evolve, Zelle’s core infrastructure and strategic partnerships position it to capitalize on new revenue streams—ensuring that “free” transfers remain profitable for years to come.

FAQ: How Does Zelle Make Money?

Q1: How does Zelle make money if users pay nothing?

A1: Zelle charges banks integration and per‑transaction fees, plus merchants a small processing fee. It also earns interest on held funds and monetizes anonymized data.

Q2: Do banks lose money paying Zelle fees?

A2: No. Banks view Zelle fees as a cost of customer acquisition, retention, and digital engagement—cheaper than legacy tools like paper checks or wires.

Q3: Does Zelle charge merchants to accept payments?

A3: Yes. Merchants pay roughly a 1% fee per transaction, similar to debit‑card interchange.

Q4: Is Zelle profitable?

A4: While Early Warning Services does not publicly break out P&L, its $1 trillion+ annual volume and diversified fee streams indicate strong profitability.

Q5: Can Zelle generate revenue from data?

A5: Absolutely. Zelle offers banks premium analytics dashboards and sells aggregated, anonymized trends to research partners.

Q6: How does fraud affect Zelle’s revenue model?

A6: Rising P2P fraud drives investment in fraud‑detection services, which Zelle monetizes—but it also raises litigation and reimbursement costs for partner banks.

Ready to Dive Deeper?

Have more questions about digital payments, Zelle’s future, or tips for maximizing your banking app? Leave a comment below, share this article with friends, or subscribe to our newsletter for weekly insights on fintech innovations!